lake county real property taxes

This fee is paid to our vendor for the processing. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400.

The New Age In Indiana Property Tax Assessment

Please contact that office at 440 350-2516.

. Base tax is calculated by multiplying the assessed value with the corresponding tax rates and is an estimate of what an owner not benefiting from any exemptions would pay. Ad Find Out the Market Value of Any Property and Past Sale Prices. Use the to find a group of parcels.

002 - TOWN OF BERLIN 004 - TOWN OF BROOKLYN 006 - TOWN OF GREEN LAKE 008 - TOWN OF KINGSTON 010 - TOWN OF MACKFORD 012 - TOWN OF MANCHESTER 014 - TOWN OF MARQUETTE 016 - TOWN OF PRINCETON 018 - TOWN OF ST MARIE 020 - TOWN OF SENECA 141 - VILLAGE OF KINGSTON. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. My staff is dedicated to providing information you need to make informed decisions in a clear and transparent manner.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. For best results leave off the street suffix.

How do I correct or update a propertys owner andor tax mailing address. Search by Owner name. Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes.

It may not reflect the most current information pertaining to the property of interest. They are a valuable tool for the real estate industry offering both buyers. Search by parcel number.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you. Information provided to the public on this site is collected and used by the Lake County Property Appraiser for the sole purpose of ad valorem assessment administration in accordance with the Florida Constitution Statutes and Administrative Code.

Real Estate Tax Parcel. Lake County Sales Tax Rate -. Current Real Estate Tax.

IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Our team has a vast array of knowledge and experience to assist you with property taxes driver license or motorist services motor vehicle registrations Concealed Weapon Permits and many other services. 3 rows TAXES PER 100000 ACTUAL VALUE 2021 Mill Levy City- Tax Area 114 112.

Type the parcel ID into the search box above. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office.

The taxpayer is responsible for delinquent fees and penalties resulting from such unavailability. The Lake County Treasurers office accepts payments for property taxes. Payments are due approximately 20-30 days after they are mailed.

The Office is best known by the public for issuing motor vehicle licenses and collecting property taxes. Assessed value in Lake County is usually calculated by multiplying market value by the countys predetermined ratio which is currently set at 35. The 2021 Real Property Tax Bills are available online at httpswwwLakeMTgov You may view print and pay your tax bill online.

As your Lake County Property Appraiser Im working to improve this site with information important to Lake County home and business owners. Generally speaking tax bills are mailed out sometime mid-January and mid-June. Lake County collects on average 137 of a propertys assessed fair market value as property tax.

Please note that there is a processing fee associated with using a credit card e-check or debit card. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy. Discover Lake County Treasurer Property Taxes for getting more useful information about real estate apartment mortgages near you.

Lake County IL Property Tax Information. Payments made online must be received by 500 pm MST on 11302021. By proceeding to use this website each visitor agrees to waive release and indemnify Lake County its agents consultants contractors and employees from any and all claims actions or causes of action for damages or injury to persons or property arising from the use or inability to use Lake County.

Lake County Stats for Property Taxes Explore the charts below for quick facts on Lake County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state and nationwide trends. Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. The collection begins on November 1st for the current tax year of January through December.

I welcome your comments and ideas on how we may continue to improve our. View or pay property tax online. Type in full name or part of the name into the Owner box.

These fees are not retained by Lake County and therefore are not refundable for any reason. Property taxes account for the majority of the revenue in the county budget. They are maintained by various government offices in Lake County Indiana State and at the Federal level.

Discover Lake County Sales Tax Rate for getting more useful information about real estate apartment mortgages near you. The Treasurer-Tax Collectors Office does not guarantee uninterrupted availability of the websites. Lake County property owners have multiple options for paying their taxes.

Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. Lake County Tax Collectors Office. There is a 3 convenience fee to pay by creditdebit cards.

Notice Of Real Estate Tax Due Dates. The Lake County Treasurers Office seeks to provide taxpayers with the best possible services to the meet continued and growing needs of Lake County. County- Tax Area.

Use as a wild card to match any string of characters. Penalty Cancellation Form Pay Property Tax. Online by phone by mail using the drop box located outside the Law Enforcement Center or in person.

Our office is focused on providing swift service with accuracy and exceptional customer service.

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

50 Counties With The Highest Lowest Property Tax Assessments Cheapism Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Understanding California S Property Taxes

Property Taxes Lake County Tax Collector

The Cook County Property Tax System Cook County Assessor S Office

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Pay Taxes By Credit Card E Check Treasurer

What Is A Florida County Real Property Trim Notice

Understanding Your Property Tax Statement Cass County Nd

Property Taxes Lake County Tax Collector

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

The New Age In Indiana Property Tax Assessment

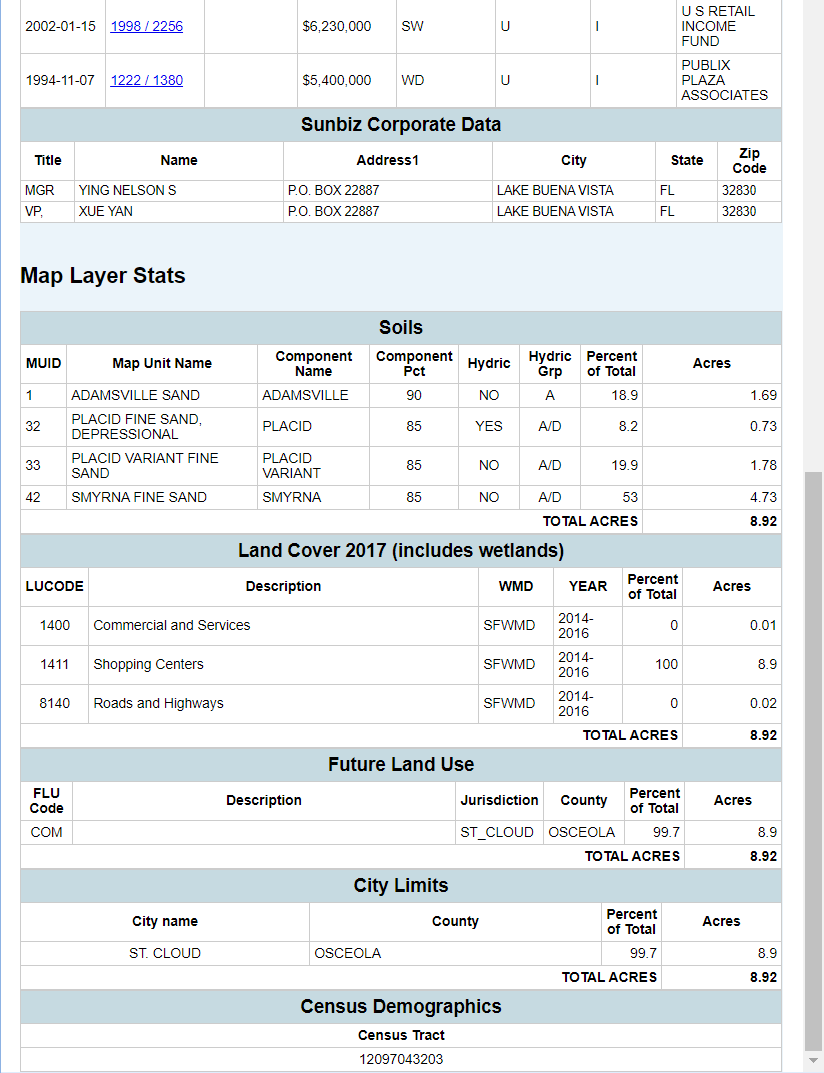

Florida County Property Appraiser Search Parcel Maps And Data